OperationsInvesting activitiesFinancing activities

Cash Flow Statement

The statement of cash flows is part of the financial statements, and as such is heavily reviewed by the users of the financial statements. Cash flow statement is a statement which shows the sources of cash inflow and uses of cash out- flow of the business concern during a particular period of time. It is the statement, which involves only short-term financial position of the business concern. Cash flow statement provides a summary of operating, investment and financing cash flows and reconciles them with changes in its cash and cash equivalents such as marketable securities

Cash flow statement is the report showing sources and uses ofCash flow statement explains the inflow and out flow of cash during the particularThe main objective of the cash flow statement is to show the causes of changes in cash between two balance sheetCash flow statement indicates the factors contributing to the reduction of cash balance in spite of increase in profit and vice-versa.In a cash flow statement only cash receipt and payments areCash flow statement starts with opening cash balance and ends with closing cash

Purpose of a statement of cash flows:

To provide information about the cash inflows and outflows of an entity during a period. To summarize the operating, investing, and financing activities of the business.The cash flow statement helps users to assess a company’s liquidity, financial flexibility, operating capabilities, and riskThe statement of cash flows is useful because it provides answers to the following important questions:

Where did cash come from? What was cash used for? What was the change in the cash balance? Specifically, the information in a statement of cash flows, if used with information in the other financial statements, helps external users to assess:

A company’s ability to generate positive future net cash flows,A company’s ability to meet its obligations and pay dividends,A company’s need for external financing,The reasons for differences between a company’s net income and associated cash receipts and payments, andBoth the cash and noncash aspects of a company’s financing and investing transactions.

Differences between a cash budget and a cash flow statement.

A cash budget is a forecast where as a cash flow statement is an historical documentA cash budget not require as a standard ; a cash flow require a standardA cash budget is used for planning and control purposes(internal); a cash- flow statement is used to report to all stakeholders (external)statement is prepared yearly (at end of accounting period)A cash budget may be customised according to needs of business ; Cash-flow statement is prepared only in accordance with standard format .

Explain why a cash flow statement is important to shareholders. Cash flow statements are important to shareholders because they show:

the ability of a business to generate cash internallyHow much cash has been raised externallythe causes of change in liquidity or cash inflows cash outflowsViability whether business can generate cash to service finance, pay tax and maintain its fixed assets going concernstability of business reliance upon internal sources external sources for financingprofitability and liquidity reconciled as shareholders Jan confuse profitability with liquidityindication of future cash flows ; capital investment (expansion of activities) and its effect on future cash

Explain how a company can make a loss but still have an increase in cash. General discussion of the differences between cash and profit:

Timing differences – profits are recorded in the profit and loss account when the transaction is made but the cash may not be received for some time.Other payments – payments for fixed assets result in cash leaving the business but do not reduce profit.Other receipts – share issues or loans received will increase cash but are not shown in the profit and loss account.Non-cash items – provisions are made in the profit and loss account that do not involve the movement of cash e.g. depreciation

Explanation of how a company can make a loss and still increase cash balance: Non-cash items – provisions for depreciation or bad debts will reduce the profit figure but have no effect on cash for example. Timing differences: the company may have recorded purchases but not paid for them yet for example. Other receipts: The company may have issued shares or taken out loans during the year and these will increase the cash balance but not affect the profit figure for example. Discuss the extent to which cash is more significant for business survival than profit. Cash is essential for short term survival. Without cash, a business may not be able to meet its liabilities and therefore may lose profit or even be forced into liquidation by its creditors. Also the business may not be able to pay dividends and hence lose the confidence of shareholders. Profit is needed for long term survival to ensure that funds are generated to enable the business to invest and to pay dividends to shareholders. Explain to what extent a cash flow statement is essential in judging the financial performance of a company Focus on cash – The cash flow statement focuses on cash. Cash is the lifeblood of a business. It is possible for a business to survive for a significant period of time whilst making losses: however, without cash a business can fail quickly. Profit can be distorted, but cash is more difficult to manipulate. Cash is also seen as being a more certain figure and harder to manipulate, therefore it may be seen as a more accurate measurement of business success or failure. Profit can be distorted because decisions need to be made about: Examples such as recognition of sales distinguishing between capital and revenue expenditure depreciation.

Profit is significant

Investors are interested in profit as this is the source of dividends and significant for the long term survival of the business. Judgment: The cash flow statement is important in judging the financial performance of the business – it shows:

liquiditysolvencyFinancial adaptability.

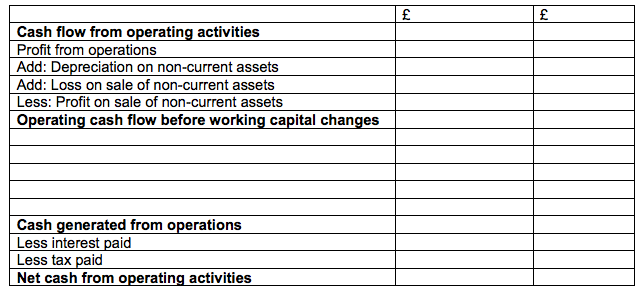

However, the remaining statements also show significant information e.g. profits/losses and assets and liabilities. about business performance. Q.No 1 The statement of financial position of Zink Pink lee plc as at 31 December 2015 and 31 December 2016 abstract were as follows: The following information is available. Additional information:

Net operating profit after interest was £Interest charges on the overdraft for the year were £a bank loan for £ 15000 at 12% interest, repayable in 3 years, was received on 1 May 2016.Depreciation is charged only on assets in the books at the yearMachine bought on 1 January 2015 had a net book value of £ 60000at 31 December 2015. And was still in the books at 31 December 2016. Depreciation is charged at the rate of 25% per year, using the straight lineComputers were bought for £ 3600 on 1 July 2015, with an expected life of 2 years. Depreciation is charged for the fraction of the year that the asset ison 1 October 2016, a motor van with a net book value of £ 12000 was sold for £on 2 December 2016, furniture with a net book value of £1800 was sold for £

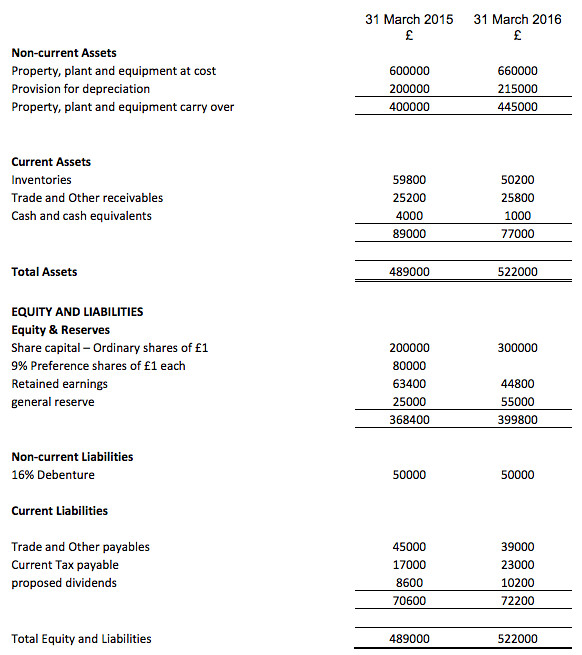

Required: The statement of cash flows for Zink Pink lee plc clearly show the net cash from operating activities section. Q. N0 2 – The statement of financial position of Blue Square plc as at 31 March 2015 and 31 March 2016 were as follows: Additional information:

On 1 April 2015, machinery which cost £ 30000, with a book value of £25000, was sold for £ 19000.a £90000 extension to the building was build and paid for during theInterest on the bank overdraft for the year was £profit after interest but before tax for the year ended 31 March 2016 was £56600 calculate the net cash flow from operating

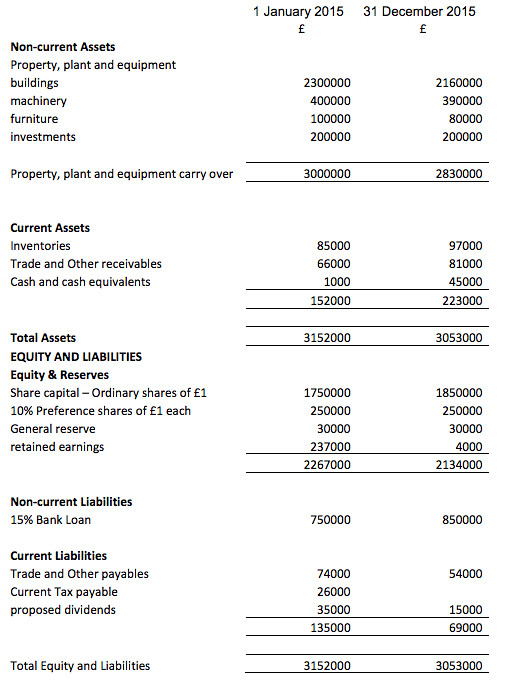

Q.no 3. The statement of financial position moonlight plc as at 1 January 2015 and 31 December 2015 were as follows: On 27 December 2015 furniture costing 40000 was purchased. No depreciation is to be provided on this new furniture for the year ended 31 December 2015. Interest on the overdraft for the year was £1000. Net operating loss (178000) Q. No 4. The statements of Financial position of Skyline ltd as at 31 December 2012 and 31 December 2013 were as follows:

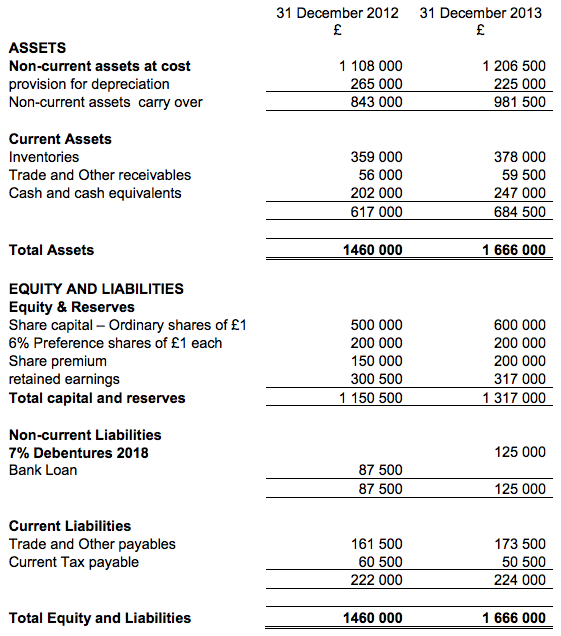

Additional information:

Machinery costing £ 129 000 was sold for £27 000 on 1 April 2013. The book value of the machinery was £20 500.Property was purchased for £227 500 on 1 MayAn issue of 100 000 £1 Ordinary shares at a premium of 50 pence per share was made on 31 MarchOrdinary shareholders received the following dividends in the year: final dividend for 2012 of 4 pence per share on 22 January 2013 an interim dividend of 2 pence per share on 26 July 2013 Preference shareholders received their dividends in full during theOn 1 January 2013 the bank loan of £87 500 was paidOn 1 May 2013 a £125 000 7% debenture was issued, with interest to be paid in two equal half-yearlyOperating profit before tax for the year ended 31 December 2013 was £111

Required:

Evaluate the raising of capital for a plc by issuing a debenture instead of taking out a bankPrepare a cash flow statement for the year ended 31 December 2013 for Skyline ltd in accordance with International Accounting Standard (IAS) 7 Cash Flow Statements (revised).

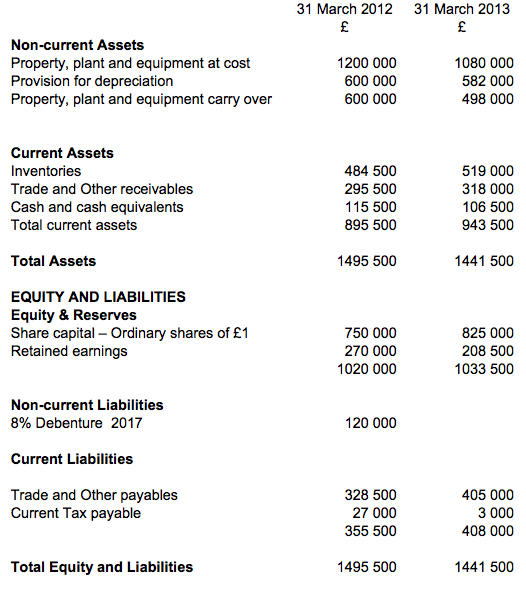

Q 5 . The Statements of Financial Position of Larnaca Distributors plc at 31 March 2012 and 31 March 2013 were as follows: Additional information:

Motor vans bought for £ 210 000 were sold for £54 000 on 1 April 2012. The carry over (net book) value of these motor vans was £ 63Computers were bought for £90 000 on 1 April 2012 and are expected to last for three years, with no residualAt 15 May 2012 a final dividend of 5 pence (£0.05) per share was paid toAn issue of 75 000 £1 Ordinary shares at par was made on 1 October 2012. All shares were purchased and have been fullyAt 30 March 2013, an interim dividend of 4 pence (£0.04) per share was paid to all OrdinaryThe £120 000 8% Debenture was repaid on 31 MarchOperating profit before tax for the year ended 31 March 2013 was £12 000

Required:

Prepare the Statement of Cash Flows for the year ended 31 March 2013 for Larnaca Distributors plc in accordance with International Accounting Standard (IAS) 7 Statements of CashEvaluate the current liquidity position of Larnaca Distributors

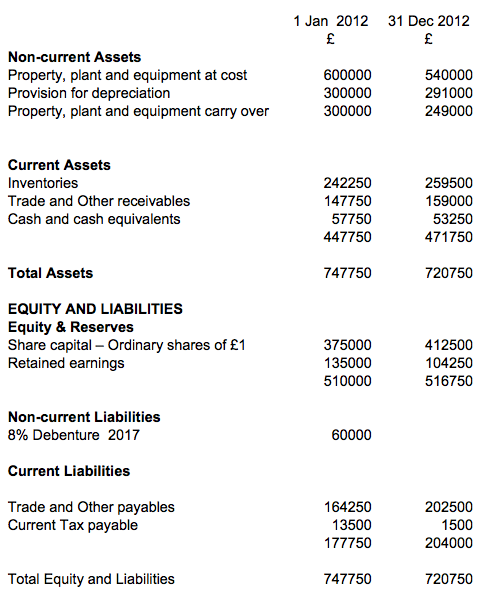

Q 6. The Statements of Financial Position of Larnaca Distributors plc at 1 January 2012 and 31 December 2012 were as follows: Additional information:

Motor vans bought for £ 105 000 were sold for £27 000 on 1 April 2012. The provision for depreciation account balance show £73Computers were bought for £45 000 on 1 April 2012 and are expected to last for three years, with no residualAt 15 May 2012 a final dividend of 5 pence (£0.05) per share was paid toAn issue of 37 500 £1 Ordinary shares at par was made on 1 October 2012. All shares were purchased and have been fullyAt 30 March 2013, an interim dividend of 4 pence (£0.04) per share was paid to all OrdinaryThe £60 000 8% Debenture was repaid on 31 DecOperating profit before tax for the year ended 31 Dec 2012 was £6 000

Required: (a) Prepare the Statement of Cash Flows for the year ended 31 March 2013 for Larnaca Distributors plc in accordance with International Accounting Standard (IAS) 7 Statements of Cash Flows. Author – Notes by KVLNSwamy M.B.A., B.Ed Recommended Articles

IndAS 7 Statement of Cash Flows – Applicability, Scope, ObjectiveAccounting Standard – 3, Cash Flow Statements Full GuideAre Cash Flow Statements mandatory?Cash Basis Vs Accrual Basis of AccountingFund Flow Statement – Meaning & Preparation GuideInd AS 40 Investment PropertyIndian Accounting Standard (IndAS 2)Reverse Mortgage – Features, Meaning, Eligibility, Taxation