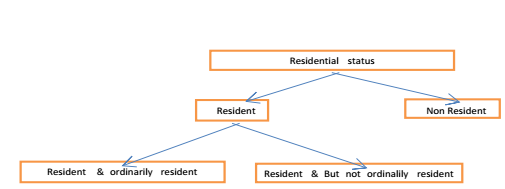

If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” freely “ Recommended Articles It’s very important to determine the residential status of an assessees before thinking about the amount of income tax to be paid by him. The reason for this is ” Tax is levied based on the residential status of an assessee.” To determine residential status one needs to first find out whether he’s a resident or non resident.

Residential status of an individual :

Determination of residential status of an assessee depends upon satisfaction of following conditions. If an individual satisfies “ANY ONE” of the following conditions, he is said to be “Resident” in India for that financial year. The conditions are:- A) Basis conditions : 1.The assessees stays in India for182 days or more during the financial year. Or 2.Assessee stays in India for 60 days or more during the financial year and 365 days or more during the last 4 years proceeding to the financial year. If an individual meets any 1 of these two conditions then he is said to be resident in India for that financial year. if none of the conditions is satisfied, he is said to be a non Resident Indian (NRI). Exceptions : In the two special cases given below, residential status of an Individual shall be determined only on the basis of basic condition 1

- 2 nd condition stated above shall not be applicable In case of an individual, who is a citizen of India and who leaves India in any financial year for the purpose of employment outside India. In such cases only first condition is enough to determine his residential status.

- If an Indian citizen or a person of Indian origin who comes on a visit to India during the previous year then first condition is enough to decide his residential status. In these two exceptional cases, an individual will be a resident in India only if he is in India during the relevant previous year for at least 182 days. How to determine the residential status as ordinarily resident & not ordinarily resident.: Following are the Additional conditions that need to be satisfied to check if a resident individual is ordinarily resident in India or not.

- Assessee should be Resident in India for at least 2 years out of 10 years preceding the financial year for which you are determining the status. And 2.He has been in India for a period of 730 days or more during the 7 years immediately preceding the relevant previous year. We can say that an Individual becomes resident and ordinarily resident in India if he satisfies at least one of the basic conditions and both the additional conditions.

Important points to be known for better interpretation :

A person is said to be of Indian origin if he or either of his parents or any of his grand-parents were born in undivided India. It may be noted that grand-parents include both maternal and paternal grand-parents.Citizenship of a country and residential status are different concepts. A person may be an Indian national but may not be a resident in India. On the other hand, a person may be a foreign citizen but may be a resident in India.Day of leaving India and the day of arriving in India will be considered for residential status determination.Stay in India includes stay in the territorial water of India i.e. 12 nautical miles in to the sea from the Indian coastal line.

Rule of taxation on the basis of residential status of the assessee

The following chart highlights the tax incidence in case of different persons on the basis of their residential status : (*) ROR means resident and ordinarily resident. NOR means resident, but not ordinarily resident. NR means non-resident