ISD under GST

It is important to note that the ISD mechanism is meant only for distributing the credit on common invoices pertaining to input services only and not goods (inputs or capital goods). Companies may have their head office at one place and units at other places which may be registered separately. The Head Office would be procuring certain services which would be for common utilization of all units across the country. The bills for such expenses would be raised on the Head Office. But the Head Office itself would not be providing any output supply so as to utilize the credit which gets accumulated on account of such input services. Since the common expenditure is meant for the business of all units, it is but natural that the credit of input services in respect of such common invoices should be apportioned between all the consuming units. ISD mechanism enables such proportionate distribution of credit of input services amongst all the consuming units. The concept of ISD under GST is a legacy carried over from the Service Tax Regime. An ISD will have to compulsorily take a separate registration as such ISD and apply for the same in form GST REG-1. There is no threshold limit for registration for an ISD. The other locations may be registered separately. Since the services relate to other locations the corresponding credit should be transferred to such locations (having separate registrations) as the output services are being provided there. For the purposes of distributing the input tax credit, an ISD has to issue an ISD invoice, as prescribed in rule 54(1) of the CGST Rules, 2017, clearly indicating in such invoice that it is issued only for distribution of input tax credit. The input tax credit available for distribution in a month shall be distributed in the same month and details furnished in FORM GSTR-6. Further, an ISD shall separately distribute both the amount of ineligible and eligible input tax credit. The input tax credit on account of central tax and State tax or UT tax in respect of recipient located in the same state shall be distributed as central tax and State tax or UT tax respectively. The input tax credit on account of central tax and State tax or UT tax shall, in respect of a recipient located in a State or Union territory other than that of the ISD, be distributed as integrated tax and the amount to be so distributed shall be equal to the aggregate of the amount of input tax credit of central tax and State tax or Union territory tax that qualifies for distribution to such recipient. The input tax credit on account of integrated tax shall be distributed as integrated tax. Let’s take an example to understand this concept. The Corporate office of ABC Ltd., is at Bangalore, with its business locations of selling and servicing of goods at Bangalore, Chennai, Mumbai and Kolkata. Software license and maintenance is used at all the locations, but invoice for these services (indicating CGST and SGST) are received at Corporate Office. Since the software is used at all the four locations, the input tax credit of entire services cannot be claimed at Bangalore. The same has to be distributed to all the four locations. For that reason, the Bangalore Corporate office has to act as ISD to distribute the credit. If the corporate office of ABC Ltd, an ISD situated in Bangalore receives invoices indicating Rs. 4 lakhs of Central tax, Rs.4 lakhs of State tax and Rs. 7 lakhs of integrated tax, it can distribute central tax, State tax as well as integrated tax of Rs. 15 lakhs as credit of integrated tax amongst its locations at Bangalore, Chennai, Mumbai and Kolkata through an ISD invoice containing the amount of credit distributed. So in what ratio will the credit be distributed by the ISD? The credit has to be distributed only to the unit to which the supply is directly attributable to. If input services are attributable to more than one recipient of credit, the distribution shall be in the pro-rata basis of turnover in the State/Union Territory. For example, if an ISD has 4 units across the country. However, if a particular input service pertains exclusively to only one unit and the bill is raised in the name of ISD, the ISD can distribute the credit only to that unit and not to other units. If the input services are common for all units, then it will be distributed according to the ratio of turnover of all the units. The following illustration will clarify the issue M/s XYZ Ltd, having its head Office at Mumbai, is registered as ISD. It has three units in different states namely ‘Mumbai’, ‘Jabalpur’ and ‘Delhi’ which are operational in the current year. M/s XYZ Ltd furnishes the following information for the month of July, 2017 & asks for permission to distribute the below input tax credit to various units.

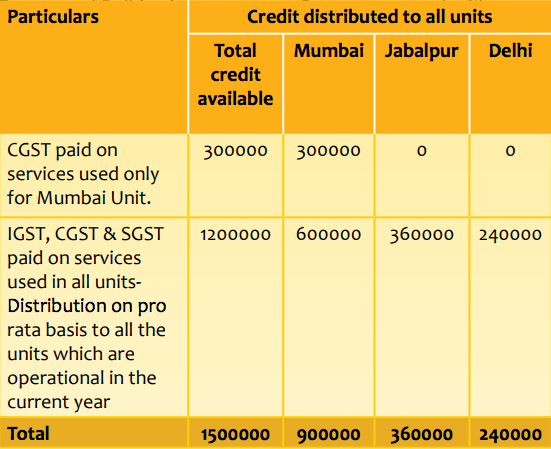

(i) CGST paid on services used only for Mumbai Unit: Rs.300000/-(ii) IGST, CGST & SGST paid on services used for all units: Rs.1200000/-

Total Turnover of the units for the Financial Year 2015-16 are as follows: – Note 1: Credit distributed pro rata basis on the basis of the turnover of all the units is as under: –

(a) Unit Mumbai: (50000000/100000000) *1200000 = Rs.600000(b) Unit Jabalpur: (30000000/100000000) *1200000 = Rs.360000(c) Unit Delhi: (20000000/100000000) *1200000 = Rs.240000

An ISD will have to file monthly returns in GSTR-6 within thirteen days after the end of the month and will have to furnish information of all ISD invoices issued. The details in the returns will be made available to the respective recipients in their GSTR 2A. The recipients may include these in its GSTR-2 and take credit. An ISD shall not be required to file Annual return. An ISD cannot accept any invoices on which tax is to be discharged under reverse charge mechanism. This is because the ISD mechanism is only to facilitate distribution of credit of taxes paid. The ISD itself cannot discharge any tax liability (as person liable to pay tax) and remit tax to government account. If ISD wants to take reverse charge supplies, then in that case ISD has to separately register as Normal taxpayer. Conclusion: Thus the concept of ISD is a facility made available to business having a large share of common expenditure and billing/payment is done from a centralized location. The mechanism is meant to simplify the credit taking process for entities and the facility is meant to strengthen the seamless flow of credit under GST. Recommended Articles

Debit Note under GSTProvisional Assessment under GSTCredit Note under GSTGST Rates in IndiaGST Invoice FormatGST RegistrationGST LoginGST ReturnsGST on AdvertisementSpecial Audit under GSTGST on Govt