Know GST Return Status

1. Can I track the status of my Return Application?

Yes, you can track the status by using the Services > Returns> Track Return Status service from the GST Portal.

2. What are different Return application status types?

TO BE FILED : Return due but not filedSUBMITTED BUT NOT FILED: Return Validated but pending filingFILED – VALID: Return FiledFILED – INVALID: Return Filed but tax not paid or short paid

I am a taxpayer. How can I track return status that I have submitted after logging to the GST Portal?

On submission of the return, you will be given an Application Reference Number (ARN). You can track status of your application by tracking this ARN. To track return status, perform the following steps:

Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.Login to the GST Portal with valid credentials.Click the Services > Returns> Track Return Status command.

In Case of ARN:

a) In the ARN field, enter the ARN received on your e-mail address when you submitted the return.b) Click the SEARCH button.

The Application status is displayed. In Case of Return Filing Period:

a) Select the Submission Period of the return using the calendar.b) Click the SEARCH button.

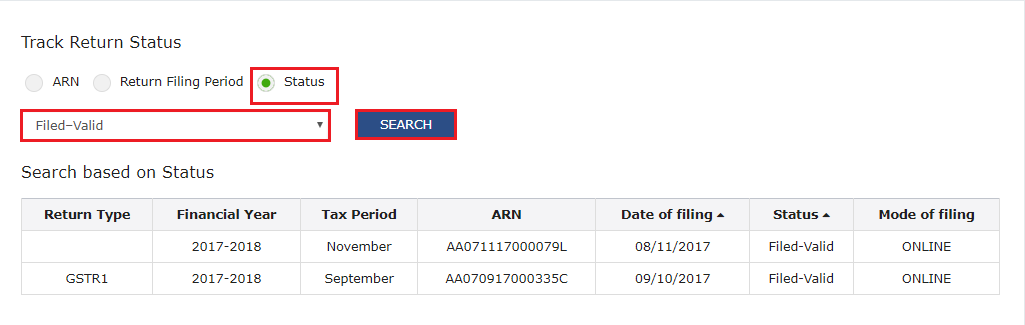

The Application status is displayed. In Case of Status:

a) Select the Status of the return from the drop-down list.b) Click the SEARCH button.

The Application status is displayed.

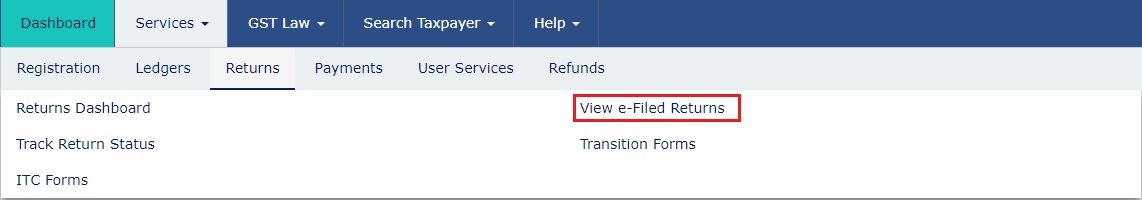

How to View e-filed Returns

1. Can I view or download my previously e-filed returns?

Yes, you can view and download your e-filed returns by using the Services > Returns> View e-Files Returns service from the GST Portal. However, for certain returns like GSTR 1 and GSTR2, only summary report of the return will be viewable/downloadable.

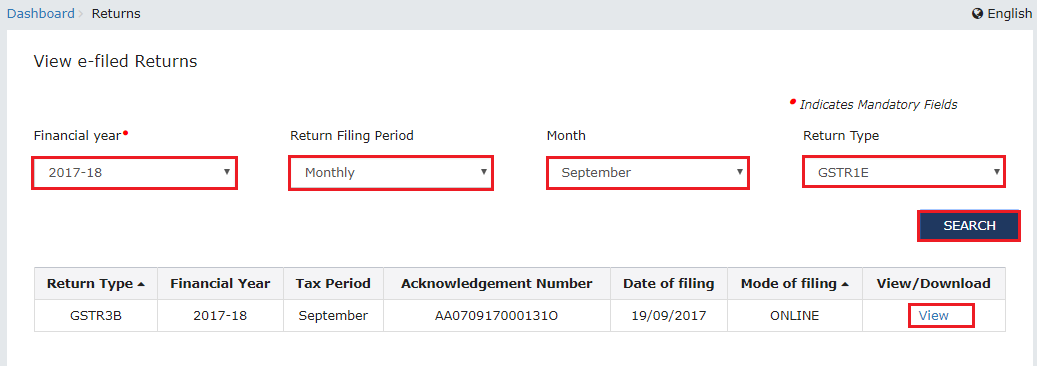

I am a taxpayer. How can I view my e-filed return?

To view your e-filed return, perform the following steps: 3. Select the Financial Year, Return Filing Period and Return Type from the drop-down list. Note:

In case of Return Filing Period as Quarterly, select the Quarter from the drop-down list.In case of Return Filing Period as Monthly, select the Month from the drop-down list.

- Click the SEARCH button. The search results are displayed. You can click the View link to view the return. If return type is not selected, for normal taxpayer GSTR-1, GSTR 2 and GSTR-3/3B will be listed and the taxpayer need to click View Button. If return type is not selected for Quarterly Return Filing Period, GSTR 4 will be listed and the taxpayer need to click View Button. Recommended Articles

GST Registration StatusGST ARN Number StatusKnow your GST NumberTrack GST Payment StatusGST Refund Status History of GST