Meaning and Scope of GST

Author Details Currently there are various types of indirect taxes like VAT, CST, Excise, Service tax, Entertainment tax, Entry tax etc which not only increase the compliance burden on a person, it also leads to double taxation, various hurdles in free flow of goods, setoff is not allowed for one tax with another i.e. you cannot take input of Service tax paid against your output VAT liability. Hence, GST is being adopted to streamline the indirect taxation picture by eliminating various taxes and providing path for one tax in all over India.

i) CGST which will be collected by Central Government ii) SGST or UTGST which will be collected by State or Union Territory government respectively and iii) IGST which will be levied on interstate transactions and it is managed by Central Government.

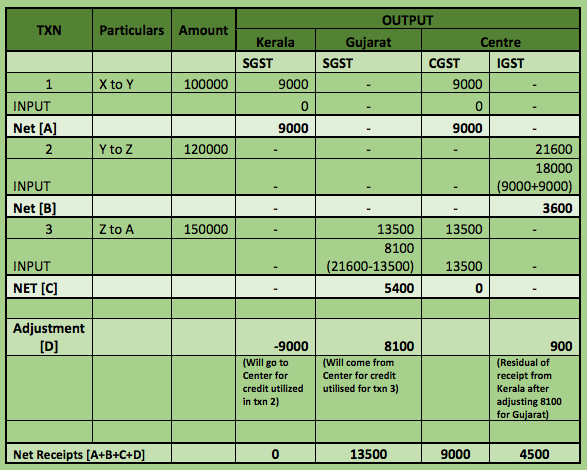

Mr A. GST is a destination based tax and hence the state part of tax belongs to the state where the goods or services are lastly consumed or provided. IGST would be broadly CGST plus SGST and shall be levied on all inter-State taxable supplies. The inter-State seller will pay IGST after adjusting available credit of IGST, CGST, and SGST on his purchases. The Exporting State will transfer to the Centre the credit of SGST used in payment of IGST. The Importing dealer will claim credit of IGST while discharging his output tax liability in his own State. The Centre will transfer to the importing State the credit of IGST used in payment of SGST. This is how the tax will be ultimately transferred to importing state. To understand this concept, please refer an example where Mr. X (Trader in Kerala) sold goods to Mr. Y (Trader in Kerala) and then Mr. Y sold goods Mr. Z (Trader in Gujarat) and lastly Mr. Z sold goods to Mr. A (Trader in Gujarat):

Here, we can find that the tax paid in Kerala will eventually migrate to Gujarat (Place of final consumption/destination). i) CGST input tax paid shall first be utilized for payment of CGST output liability and any amount remaining can be utilized towards payment of IGST. ii) SGST input tax paid shall first be utilized for payment of SGST and any amount remaining can be utilized towards payment of IGST. iii) IGST input tax paid shall first be utilized for payment of IGST and any amount remaining shall then be utilized first for CGST and then for SGST in that order. MJL & Co, Jaipur (Chartered Accountants) Email – MJLco.jaipur@gmail.com (ph – 0141-4915113) Recommended Articles

When will GST be applicableFiling of GST ReturnsGST RegistrationGST RateGST FormsHSN Code ListGST LoginGST Registration last dateGST Refund FormatsGST RefundGST Registration StatusInterest on late payment of GST