Location of Supplier: It is the registered place of business of the supplier.Place of Supply: It is the registered place of business of the recipient.

This, in turn, makes the concept of place of supply crucial under GST as all the provisions of GST revolves around it.

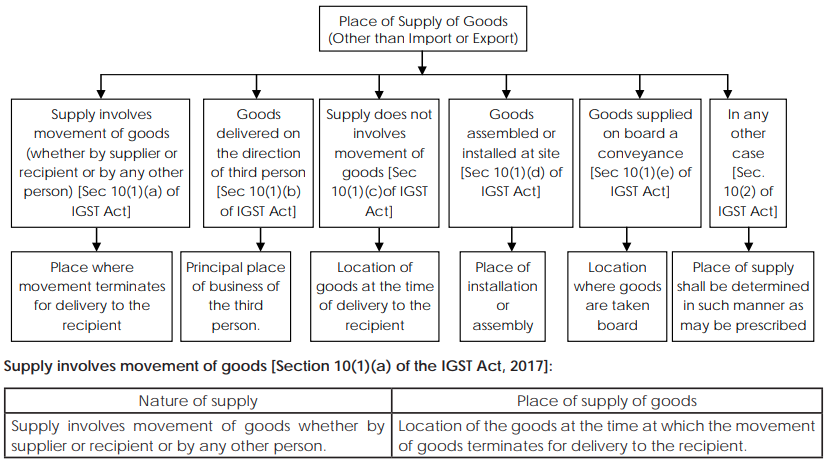

Place of Supply of Goods

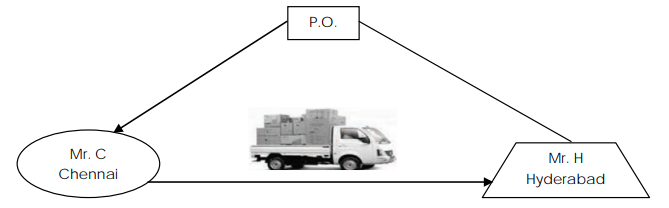

As per section 10 of the CGST Act, 2017 Place of Supply of goods other than supply of goods imported into, or exported from India, shall be as under: Place of supply of goods under GST defines whether the transaction will be counted as intra-state or inter-state, and accordingly levy of SGST, CGST & IGST will be determined. Example: Mr. C of Chennai received purchase order from Mr. H of Hyderabad for want of commercial goods. Now supply involves movement of goods by supplier from Chennai to Hyderabad in a truck by road.

Place of supply of goods = Hyderabad. IGST will be levied.

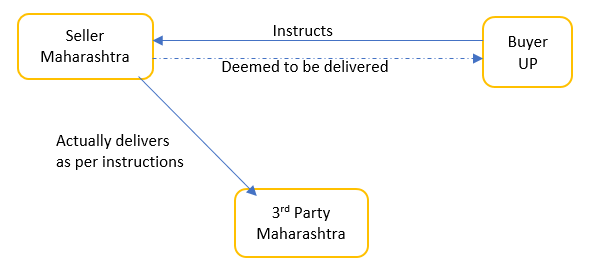

Declared outward supply of goods in Table 5 of GSTR – 1, supplier should indicate place of supply where location of supplier and recipient are different. The supplier delivers goods to a recipient or any other person on the direction of a third person by way of transfer of documents of title to the goods or otherwise [Section 10(1)(b) of the IGST Act 2017]: Browse by topics:

Movement of goodsNo movement of goodsGoods supplied on a vessel/conveyanceImports & exports

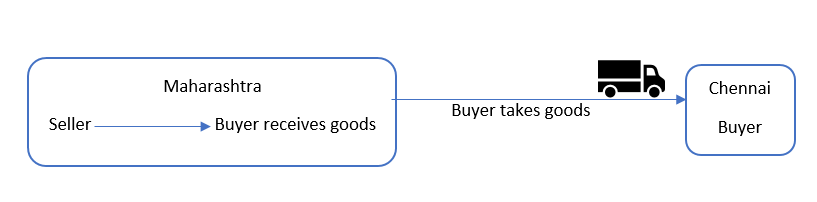

Example 1- Intra-state sales Mr. Raj of Mumbai, Maharashtra sells 10 TV sets to Mr. Vijay of Nagpur, Maharashtra The place of supply is Nagpur in Maharashtra. Since it is the same state CGST & SGST will be charged. Example 2-Inter-State sales Mr. Raj of Mumbai, Maharashtra sells 30 TV sets to Mr. Vinod of Bangalore, Karnataka The place of supply is Bangalore in Karnataka. Since it is a different state IGST will be charged. Example 3- Deliver to a 3rd party as per instructions Anand in Lucknow buys goods from Mr. Raj in Mumbai (Maharashtra). The buyer requests the seller to send the goods to Nagpur (Maharashtra) In this case, it will be assumed that the buyer in Lucknow has received the goods & IGST will be charged. Place of supply: Lucknow (UP) GST: IGST Example 4- Receiver takes the goods ex-factory Mr. Raj of Mumbai, Maharashtra gets an order of 100 TV sets from Sales Heaven Ltd. of Chennai, Tamil Nadu. Sales Heaven mentions that it will arrange its own transportation and take TV sets from Mr. Raj ex-factory Place of supply: Maharashtra GST: CGST & SGST As, the goods are received ex-factory, i.e., in Maharashtra, the movement of the goods terminates for delivery to the recipient there. It is immaterial whether the receiver further transports the goods or not. Example 5 – E-commerce sale Similar to example 3, it will be assumed that the buyer in Mumbai has received the goods & IGST will be charged. Place of supply: Mumbai, Maharashtra GST: IGST

No Movement of Goods

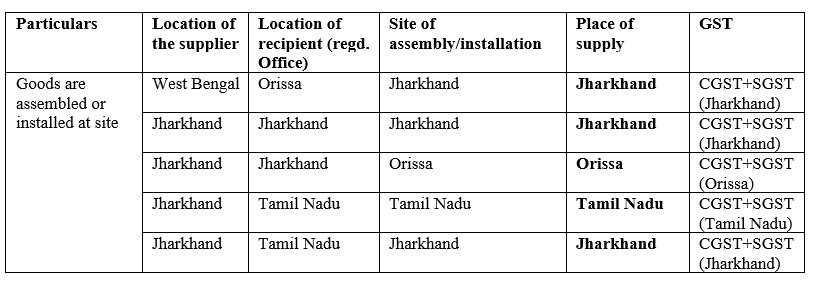

Example 1- No movement of goods Sales Heaven Ltd. (Chennai) opens a new showroom in Bangalore. It purchases a building for showroom from ABC Realtors (Bangalore) along with pre-installed workstations Place of supply: Bangalore GST: CGST& SGST There is no movement of goods (work stations), so the place of supply will be the location of such goods at the time of delivery (handing over) to the receiver. Note: There is no GST on purchase of building or part thereof. RENT of commercial space attracts GST Example 2- Installing goods Strong Iron & Steel Ltd. (Jharkhand) asks M/s SAAS Constructions (West Bengal) to build a blast furnace in their Jharkhand steel plant Place of supply: Jharkhand GST: CGST & SGST Although M/s SAAS is in West Bengal, the goods (blast furnace) is being installed at site in Jharkhand which will be the place of supply. Note: M/s SAAS will have to be registered in Jharkhand to take up this contract. They can opt to register as a casual taxable person which will be valid for 90 days (extendable by 90 days more, on basis of a reasonable cause).

Goods Supplied on a Vessel / Conveyance

Example 1- Plane Mr. Ajay is travelling from Mumbai to Delhi by air. He purchases coffee and snacks while on the plane. The airlines is registered in both Mumbai and Delhi. Place of supply: Mumbai GST: CGST& SGST The food items were loaded into the plane at Mumbai. So, place of supply becomes Mumbai. Example 2- Plane- Business travel Mr. Ajay is travelling from Mumbai to Chennai by air on behalf of his company Ram Gopal and Sons (registered in Bangalore). In the plane he purchases lunch. The airlines is registered in Mumbai & Chennai. Place of supply: Mumbai GST: CGST & SGST The food items were loaded into the plane at Mumbai. So, place of supply becomes Mumbai. It does not matter where the buyer is registered. Example 3- Train Mr. Vinod is travelling to Mumbai via train. The train starts at Delhi and stops at certain stations before Mumbai. Vinod boards the train at Vadodara (Gujarat) and promptly purchases lunch on board. The lunch had been boarded in Delhi. Place of supply: Delhi GST: CGST & UTGST The food items were loaded into the train at Delhi. So, place of supply becomes Delhi. Place of supply of goods cannot be determined in such case, the place of supply will be determined by Parliament rules on the basis of GST Council recommendations…

Imports & Exports

The place of supply of goods:

imported into India will be the location of the importer.exported from India shall be the location outside India.

Example 1 Import Ms. Malini imports school bags from China for her shop (registered in Mumbai) Place of supply: Mumbai GST: IGST Example 2 Export Ms. Anita (Kolkata) exports Indian perfumes to UK Place of supply: Kolkata GST: Exempted

How our software can help you?

Based on your buyer’s and your GSTIN the software will automatically calculate the place of supply according to the provisions and inform you whether you will charge CGST/SGST or IGST. Recommended Articles –

GST RulesReturns Under GSTGST RegistrationGST RatesGST FormsHSN Code ListGST Login