If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing ”freely“

Procedure for Request of Re-issue of Income tax Refund

Now days Assessee who file their Income tax Return online gets their refund cheque issued by CPC Bangalore. Refunds are issued by two modes:-

By crediting the refund amount in Assessee’sbank account if the Assessee has correctly mentioned his bank details inIncome tax Return Filed by him.By sending Income Tax Refund Cheque if Assessee failed to submit or correctly mention his bankaccount details in Income tax Return filed by him.

In case of Physical cheques there may be chances that after filing of Income tax Return Assessee has moved to new address and his Income tax Refund cheque issued by CPC Bangalore returned back for non-delivery. There may also be a chance that although address is not changed but Assessee could not receive the refund order as no one was there on the day when cheque was delivered or Refund cheque returned undelivered by the postal department as the house was locked. Further in case Assessee has applied for ECS but has entered wrong account details or account of which details been entered is closed and ECS to such account been failed. In such cases one question arises what Assessee should do to request reissue of Refund cheque or how to request Credit of that account in his bank account and how to intimate the change in address? Procedure to apply for refund – reissue for refund related to AY 2009-10 and succeeding years

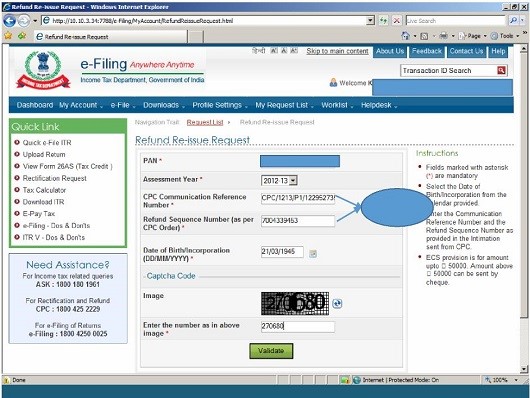

REFUND REISSUE SCREEN

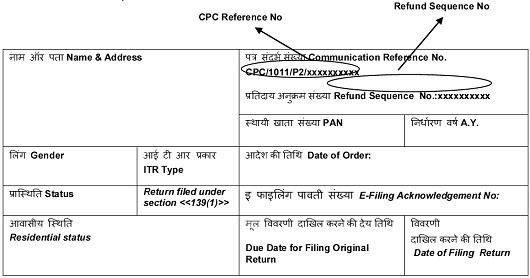

Please refer to the pictorial representation shown below; indicating the CPC reference number and refund sequence number as can be seen in the Order u/s 143(1)/154, Income Tax Act, 1961.

Intimation Pictorial Representation:

Paper return which were processed at CPC, refund reissue can be applied only through sending response directly to CPC.

please note that from AY 2013-14 onwards, Assessee need enter IFSC code instead of MICR code forFind below the table with reasons for refund failure at CPC and the resolution thereof.

Procedure to apply for refund – reissue for refund related to A.Y. 2008-09

Assessee needs to download the address/bank-details modification form (Response Sheet) from the website of Income Tax department, fill the same and after that he needs to send the same by ORDINARY or SPEED POST along with cancelled cheque and other supporting documents to: “Income Tax Department – CPC, Post Bag No – 1, Electronic City Post Office, Bangalore – 560100, Karnataka” To Download the need to take Response Sheet Assessee Following steps:- It is to be noted if there is any change in address of the Assessee needs to get the same updated with PAN master database by filing Form No. 49Afor correction in PAN Data. Recommended Articles

Check Income Tax Refund Status OnlineTop Reasons for Income Tax Refund FailureTDS Rate ChartincometaxefilingHow to Pay TDS Online Full Guide and ProcedureDownload Form 3CA 3CB 3CD In Word Excel & Java FormatIncome Tax Slab RatesList of All Incomes Exempt from Income TaxPAN Name By PAN No,Know Your PAN, Online Verify For PANHow to submit Response for Outstanding Tax Demand