If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” freely “

Like Us on Facebook https://www.facebook.com/caknowledgepageJoin Our Facebook Group https://www.facebook.com/groups/CAknowledgegroup/

Recommended Articles

National Digital Locker (DigiLocker)Deemed Dividend – Section 2(22)(e)Taxation Matters of a trust – Part 1Is rebate u/s 87A available for financial year 2016-17 ?Download Latest Income Tax Return (ITR) Forms

Services which can’t be provided by Statutory Auditors

As per SEC 144 OF THE COMPANIES ACT 2013 Auditor should not render the following services to the client where he is appointed as the statutory auditor. Generally Board of directors and / or audit committee will decide the services to be provided by the auditor during the period of his appointment. But these services can not include the following which are in a such a way that the independence of the auditor gets affected. As per This section not only the auditor himself but the following persons also cannot provide the above stated services to a company or its subsidiary or holding company in which that person is appointed as an auditor :

In case auditor is an Individual

In case an audit firm is appointed as auditor

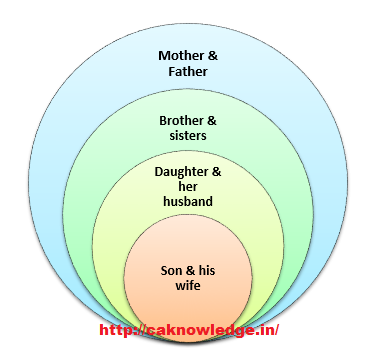

For the purpose of this section relatives include:

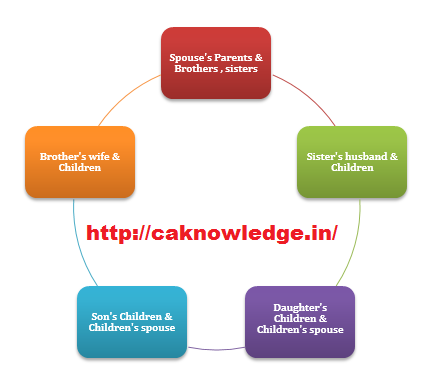

The term relatives does not include the following :

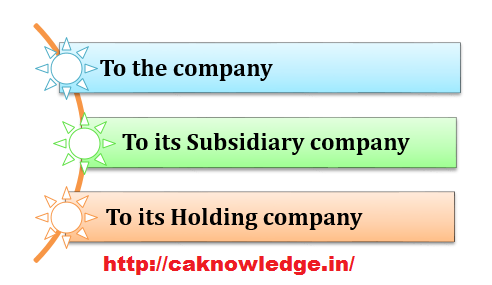

Services mentioned above should not be provided to the following also : Recommended Articles

Key man insurance policyDeduction For Donation Under Section 80GDownload Form 3CA 3CB 3CD In Word Excel & Java FormatDeduction For Medical Insurance Premium U/Sec 80d