The very definition of “GOODS” continues to remain the same even after GST implementation. For the purpose of taxation on supply of “goods” the explanation given in Article 366(29A) persists and goods exclude sale of immovable properties. Under the pre-GST India, works contract included-

Works contracts = Supply of GOODS + SERVICESWorks contract included provision of- Immovable Property related construction or other services AND Movable property and services.Gannon Dunkerley Judgment: In simple words, the judgement elucidates that a works contract involves transfer of goods, but there cannot be sales as the essential element in executing a works contract is provision of services. As there are no sales, consequently no VAT (Sales Tax in erstwhile parlance) should be levied.However, the law defines works contract as a deemed sale activity hence only the sales portion is liable to VAT

Now under the GST regime, works contract is as under:

Works Contracts = Supply of SERVICES only.Works Contract includes only: Immovable Property related construction or other services

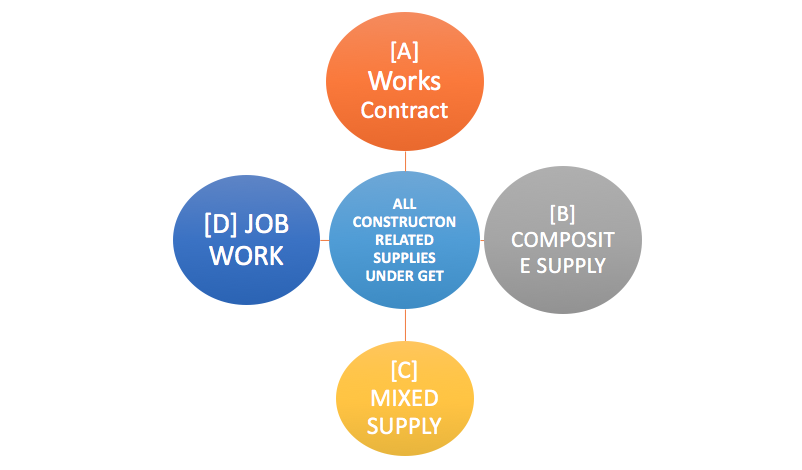

Works Contract, Composite Supply, Mixed Supply, Job Work

GST Rates

*Full ITC available. Overflow of ITC cannot be refunded.

A] Works Contract

Section 2(119) defines works contract under GST

B] Composite Supply

Section 2(27) of the CGST Act defines a composite supply: It means a supply comprising of two or more goods/services, which are naturally bundled and supplied with each other in the ordinary course of business, one of which is a principal supply. The items cannot be supplied separately

Conditions for composite supply

Any supply of goods or services will be treated as composite supply if it fulfils BOTH the following criteria:

Supply of 2 or more goods or services together, ANDIt is a natural bundle, i.e., goods or services are usually provided together in normal course of business. They cannot be separated.

Example: Where goods are packed, and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply. Insurance, transport cannot be done separately if there are no goods to supply. Thus, the supply of goods is the principal supply. Tax liability will be the tax on the principal supply i.e., GST rate on the goods. If the second condition is not fulfilled it becomes a mixed supply.

C] Mixed supply

Mixed supply under GST means two or more individual supplies of goods or services, or any combination, made together with each other by a taxable person for a single price. Each of these items can be supplied separately and is not dependent on any other. It shall not be a mixed supply if these items are supplied separately. Rate of tax: For tax under GST, a mixed supply comprising two or more supplies shall be taxed at supply of that item which has the highest rate of tax. Example: A supply of a food package in an airlines that consists of canned foods, chocolates, bottled water, aerated drink and fruit juices when supplied for a single price is a mixed supply. All can be sold separately. Assuming aerated drink have the highest GST rate, aerated drinks will be treated as principal supply and GST rate of aerated drink will apply on the single price charged.

D] Job Works

Meaning: A process undertaken by a person on goods owned by another registered taxable person.No GST is levied on Goods supplied by Registered taxable owner (principal) to job worker (Section 43A). Goods may further be sent from one job worker to another. One may note that 43A does not apply to exempted or non –taxable goods or non-registered person.ITC of inputs sent to job worker: ITC is available if the Goods (non capital) are received back in 1 year after completion of job work (3 years in case of Capital Goods sent in Job Work) from the date of being sent out. If the inputs are sent out directly, the days are counted from date of receipt of inputs by job worker.

Impact of GST on Construction IndustryGST and its impact on Salaried EmployeesKey Definitions Under GSTPlace of supply of goods and servicesSpecifically Exempted Construction Related Services