Under the GST regime, Export of service will be treated as ‘zero-rated supplies’. Accordingly, while no tax would be payable on such supplies, the exporter will be eligible to claim the corresponding input tax credits. It is relevant to note that the input tax credits would be available to an exporter even if supplies were exempt supplies as long as the eligibility of the input taxes as input tax credits is established.

Analysis

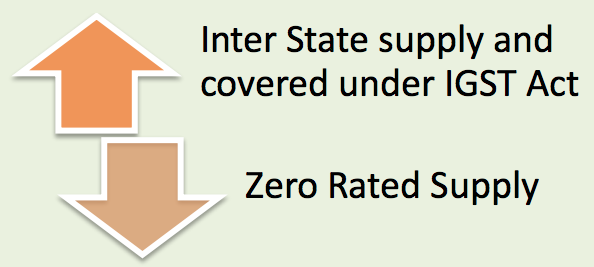

Zero-rated supply does not mean that the goods and services have a tariff rate of ‘0%’ but the recipient to whom the supply is made is entitled to pay ‘0%’ GST to the supplier. In other words, as it has been well discussed in section 17(2) of the CGST Act that input tax credit will not available in respect of supplies that have a ‘0%’ rate of tax. However, this disqualification does not apply to zero-rated supplies covered by this section. It is interesting that section 7(5) (and even proviso to section 8(1)) declares that supplies ‘to’ or ‘by’ SEZ developer or unit will be treated as an inter-State supply. So, when two SEZ units or one SEZ developer and another SEZ unit supply goods or services to each other (among themselves within the zone) and the zone being located within the same State or UT, such supplies will always be interState supplies. But, it important to note that this – being treated as inter-State supplies always.

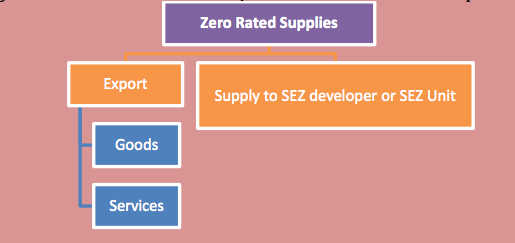

Zero Rated Supplies

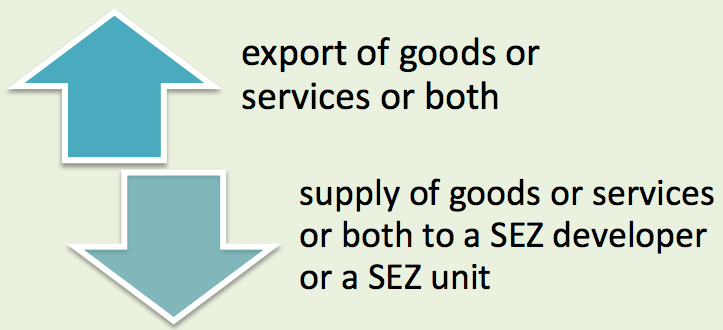

Section 16 of the IGST Act, 2017 specifies zero rated supplies as supplies of goods or services or both, namely:-

(a) export of goods or services or both; or(b) supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit.

Input Tax Credit in Zero Rated Supplies

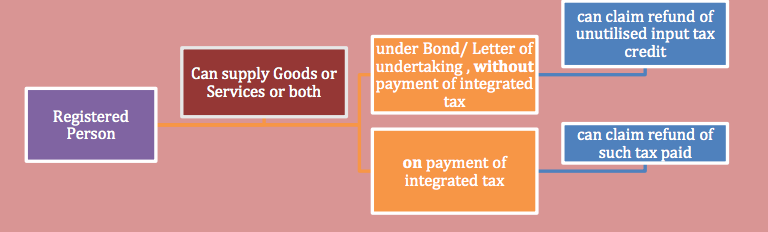

Section 16(2) specifies that Input Tax Credit will be available on making zero rated supplies, notwithstanding that such supply may be an exempt supply. Input tax credit can be availed for making zero-rated supplies, even though such zero-rated supplies may be an exempt supply. This would however be subject to section 17 of the CGST Act. A taxable person exporting goods or services would be eligible for refund under the following two options:

Export under bond without payment of integrated tax and claim refund of unutilised input tax credit; orExport on payment of integrated tax which can be claimed as refund accordingly.

Refund Procedure

A registered person making zero rated supply shall be eligible to claim refund under either of the following options, namely: (a) he may supply goods or services or both under bond or Letter of Undertaking, subject to such conditions, safeguards and procedure as may be prescribed, without payment of integrated tax and claim refund of unutilised input tax credit; or (b) he may supply goods or services or both, subject to such conditions, safeguards and procedure as may be prescribed, on payment of integrated tax and claim refund of such tax paid on goods or services or both supplied, in accordance with the provisions of section 54 of the Central Goods and Services Tax Act or the rules made thereunder. Subject to such conditions, safeguards and procedures, as may be prescribed:

Zero rated Exports:

Under the GST regime, exports will be zero rated in entirety unlike the present system where refund of some taxes is not allowed due to fragmented nature of indirect taxes between the Centre and the States. All taxes paid on the goods or services exported or on the inputs or input services used in the supply of such export goods or services shall be refunded. The exporter may utilise such credits for discharge of other output taxes or alternatively, the exporter may claim a refund of such taxes. The exporter will be eligible to claim refund under the following situations:

(a) He may export the services under a Letter of Undertaking, without payment of IGST and claim refund of unutilized input tax credit; or(b) He may export the services upon payment of IGST and claim refund of such tax paid.

Zero Rated Supply & Exports

In the GST law, Export of goods & services is treated as: Zero Rated Supply has been defined under sub section 16(1) of the IGST Act, 2017 as any of the following supplies of goods or services or both namely:

Zero Rated Supplies SEZ units

All supplies to SEZ developer or unit being zero-rated does not mean that the entire company can enjoy this form of ab initio exemption. For example, Company incorporated in Delhi may have established an SEZ unit in Jaipur. All goods and services supplied to SEZ in Jaipur will enjoy the ab initio exemption but the goods and services supplied to Delhi will be liable to tax. Now, if the incorporated address of the Company were also in Jaipur and inside the zone, the Company must be cautious to differentiate the supplies that are not related to the authorized operations in the zone but related to the other affairs of the Company and instruct the suppliers to charge applicable GST on such non-SEZ supplies. If is for this reason that proviso to Rule 1(1) of the Registration Rules provides for SEZ unit to secure separate registration as a distinct business vertical, apart from the rest of the Company. Complete use of this zero-rated exemption will invite recovery action against the SEZ developer or unit. The supplier who supplied as a zero-rated supply is not responsible for this misuse because the SEZ developer or unit would have issued the GSTIN of the zone. Further, in case GST is paid on the non-zone operations of the Company and these costs are included in the export billing, there may be some aspects to be taken care of in case post-export refund of this GST paid is sought to be claims. Please note that all supplies to SEZ developer or unit alone is treated as an inter-State supply but the supply to the Company relating to non-SEZ activities will continue to be inter-State or intra-State supply as the case may be. With all information, available online through GSTN, misuse is not difficult to identify. Care must be taken to diligently use

Comparative Review

The concept of zero rated supplies is there in the VAT laws with credit benefit and refund. As far as Central Excise law is concerned there is a rebate mechanism in place. That apart the accumulated unutilised credit is available as refund to the exporters of services/goods under rule 5 of the Cenvat Credit Rules, 2004. Q 1. What is the meaning of the term Zero Rated Supply? Ans. Zero Rated Supply refers to supplies made TO SEZ units / developers or exports of goods or services or both. Zero rated supply doesn’t necessarily mean that the above supplies are not leviable to IGST or will taxed at “0” (Zero) Rate or will be exempt from IGST unconditionally. Q 2. What is the relevance of zero rated supplies? Ans. Given that the Exports and SEZ play a pivotal role in the economic growth in India, the registered person will have two options, namely;

(a) he can make Zero Rated Supplies without payment of IGST under Letter of Undertaking or Bond and claim refund of input tax credit w.r.t to such supplies; or(b) he can make Zero Rated Supplies with payment of IGST (either by utilizing Input tax credit or by cash) and claim refund of such tax paid. However, the registered person will have to abide by the conditions, safeguards and procedures as may be prescribed.

Q 3. Are exports and supplies to SEZ units/Developers out of the ambit of GST? Ans. No. They are leviable under IGST Act, 2017. However, the tax burden on the same will be neutralized by granting refunds to persons making such supplies subject to such safeguards, conditions and procedures as may be prescribed.. Q 4. Can SEZ unit / Developers claim refund of IGST charged by his supplier? Ans. No. The IGST Act, 2017 allows the supplier of SEZ unit / developer to claim refund of IGST paid by him on supplies to SEZ unit / Developers. Q 5. Are supplies made by SEZ units/Developer are Zero rated supplies? Ans. No. only the supplies made TO SEZ units/Developer are zero rates supplies. However, Exports made BY SEZ units/Developer will be zero rated supplies.